Automotive Supplier

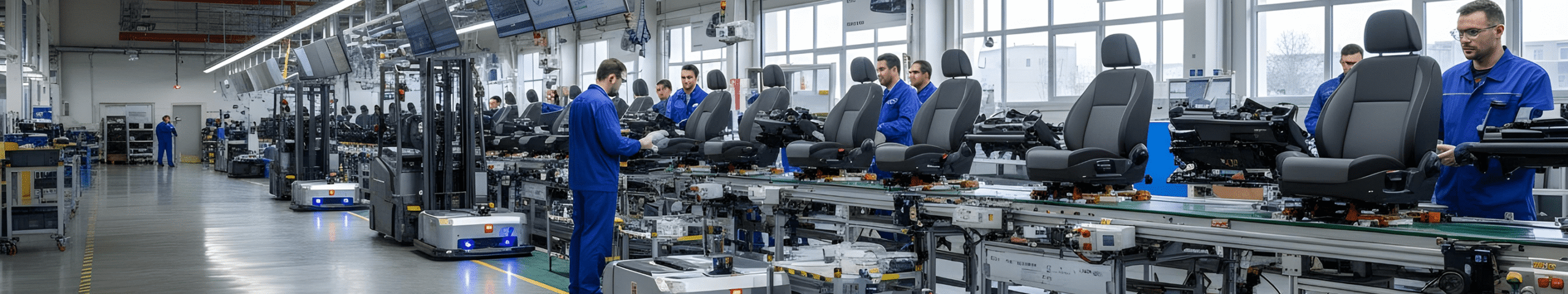

Automotive Tier 1 and Tier 2 suppliers are navigating one of the most challenging environments in decades. They face:

Intense competition with thin margins

Volatile OEM demand with frequent, last-minute plan changes

Rising costs for raw materials, labor, and capital

High debt burdens amplified by rising interest rates

Semiconductor shortages disrupting production

Massive EV investments required to stay relevant

Operational inefficiencies from complex, global supply chains

These pressures strain profitability, disrupt OEM–supplier relationships, and make long-term planning increasingly difficult.

Frequent OEM schedule changes create spikes in raw material and WIP inventories, lost capacity, and inconsistent deliveries.

KPI Impact : +30% on-time delivery, −25% production delays

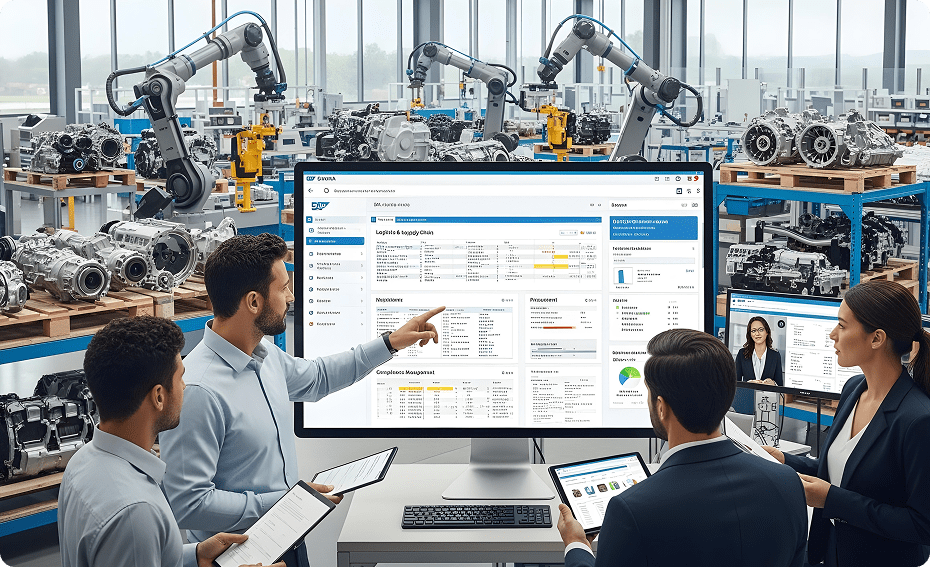

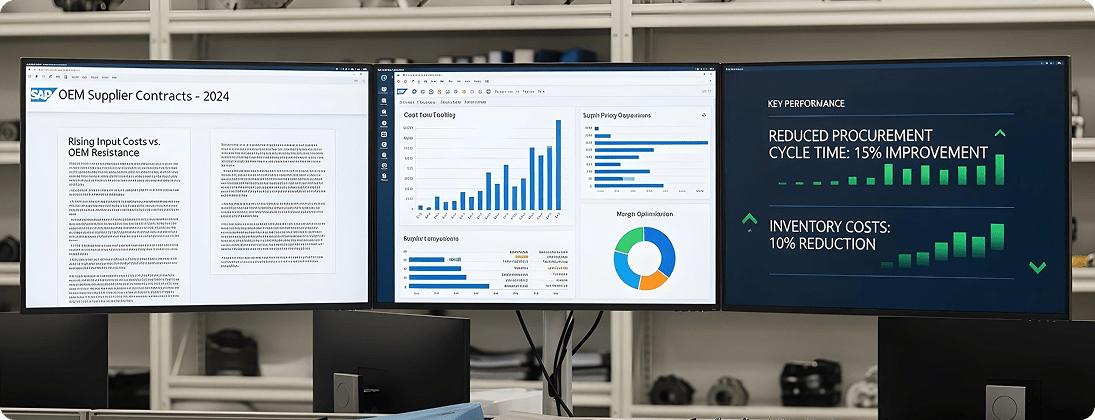

Suppliers are caught between rising input costs and OEM price resistance.

KPI Impact : – 15–20% procurement cycle time, –10–15% inventory costs

Debt from the pandemic, combined with higher borrowing costs, limits investment in innovation.

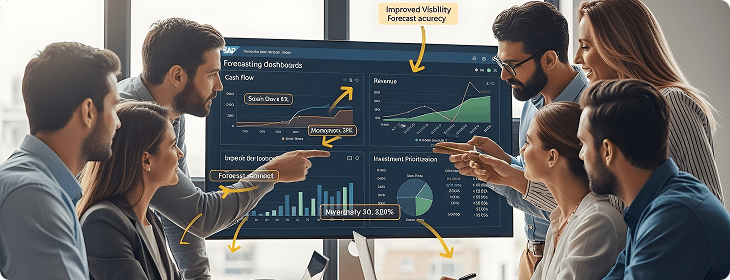

KPI Impact : +20% cash flow visibility, 95% revenue forecast accuracy

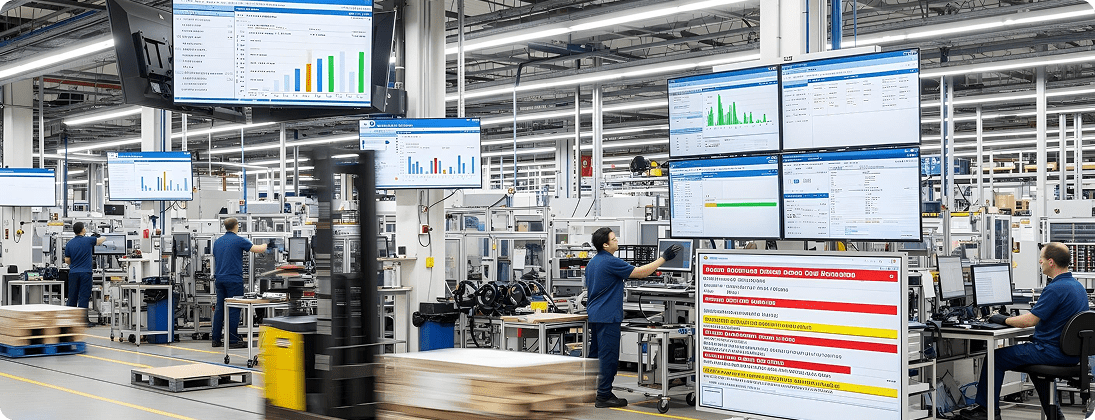

Global chip shortages continue to disrupt production.

KPI Impact : –40% production stoppages, +30% inventory visibility

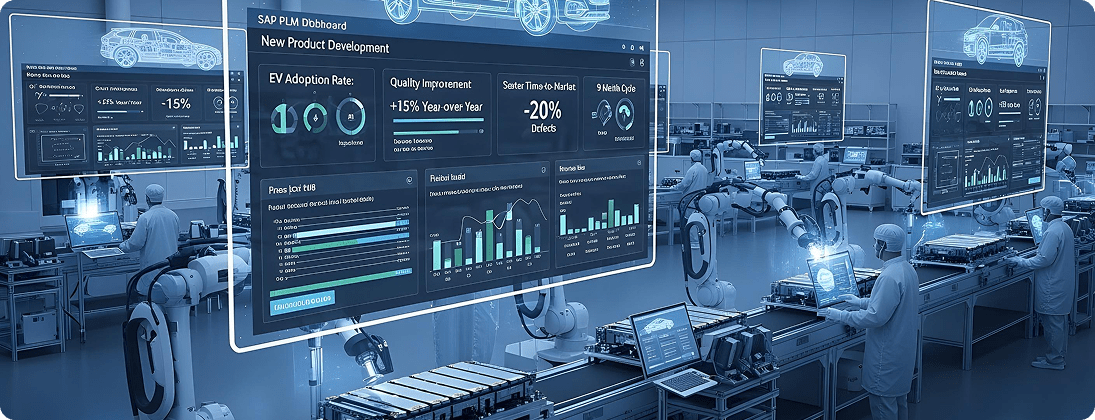

The shift to EVs requires new technology, new processes, and heavy upfront investment.

KPI Impact : 20% faster ramp-up of EV product lines, +15% first-pass quality

Complex supply chains demand agility and precision.

KPI Impact : –30% throughput times, +25% manufacturing efficiency

Suppliers must manage electrification, emissions, and safety regulations across markets.